Why Modern Businesses Need Online Accounting Software

If your business has not yet upgraded to online accounting software, you are most likely falling behind vendors, clients and peers who are already reaping its benefits. If you talk to vendors and clients who have already adopted online accounting software (or if you have friends at competing companies), they will all tell you that they have managed to reduce the data entry burden on their people, and have experienced at least some increase in productivity if not a massive increase in productivity.

They may or may not tell you the next part: online accounting software also guides users on supply chain spending and on their most profitable clients. Bookkeeping companies for instance, get a special tool that lets them offer pricing that is commensurate with the amount of work that a client’s books are likely to call for (before actually spending billable hours looking at the books).

Tax insights, cleaner data and better data management are other positives that modern businesses can get from online accounting software.

In this post, we are going to look at 5 concrete business areas - that exist in all types of businesses - that can run more effectively with online accounting software.

Data Entry

No matter what type of business you run, you have people entering data from bills, receipts and invoices into the system. It might just be people claiming reimbursements, but most likely there will also be sales and marketing folks reporting sales earnings and marketing spend, HR and payroll and of course the accounting department that painstakingly enters all transactions linked to the company so that you can have proper accounting books. If you are a startup or a one-man show, it is very likely that you - or the star you managed to hire - is the sales, marketing, payroll and accounting departments, all wrapped in one.

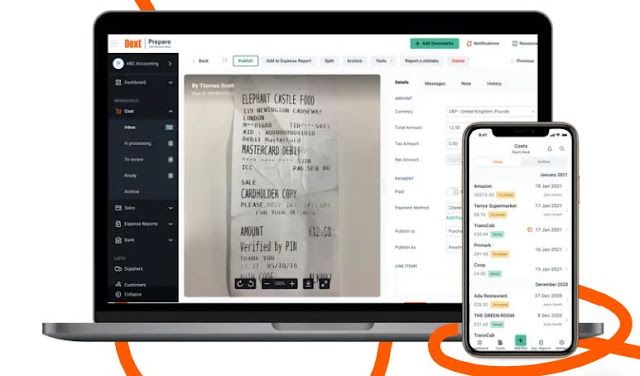

All the more reason that you need online accounting software to ease the data entry burden. A receipt scanning feature enables the software to capture essential financial details from smartphone pics or PDFs of bills, receipts, invoices, bank statements and so on.

Shaving hours of data entry off of people’s daily or weekly schedule will go a long way in improving productivity and employee sentiment because people will not only be doing away with a task that is commonly viewed as an annoying chore but also because they will have more time for their core functions.

Data Management

All entries made by the receipt scanner or pulled from your bank statement are sorted by date and category. You can also go ahead and set up personalized rules for sorting and categorisation - thereafter the system will automatically sort and file according to the rules you have set up. Suppliers can be sorted by geography or tax, for example.

Data is centralized in a single location and what’s more, you can retrieve an entry by using keywords in a search box.

Your data is also very secure because online accounting software companies safeguard client data with firewalls, and some have round-the-clock IT security teams, guarding your data from intrusions. Beware of software that is free for use eternally, though. These software providers need to earn from somewhere, that is to say: they need some profit model. If you are not paying up they either need to bombard you with ads or need to sell your data. And in any case, even free software providers will put the best features behind a paywall.

Data Correctness

Errors and anomalies in the data are flagged up by the system and all duplicates are flushed out or else merged into one when the details do not match exactly. All deletions are tracked by a top accounting SaaS program. Taxes are automatically added and we’re talking about UK-specific taxes.

High-Level Decision Making

Company bosses should be able to make decisions on vendor or client partnerships with the company’s full financial picture in mind. This means having access to current financial data on the go, and sometimes, also anywhere in the world. Online accounting software makes this modern business need possible because it gives you an accounting dashboard with a selection of business-specific KPIs. Choose items like cash flow, accounts receivable and payable, inventory stock and so on that will help your company’s decision-makers to make fully informed decisions with immediacy so that you never miss an opportunity.

The accounting dashboard, coupled with spontaneous business insights can help you track your supply chain leaks and your most lucrative customers.

Pricing

Accountants and bookkeepers can price their services appropriately, based on the number of billable hours a given gig will actually consume. A Health Checker tool built into online accounting software like Dext allows them to evaluate the health of a client’s books instantly.

Meanwhile, for just about any company, tax insights on upcoming tax laws allow them to adjust pricing models to maintain profitability by the time the laws finally come into force.

Conclusion

Modern businesses are too fast-paced for decision-makers to rely on last week’s data. The team has too many options for them to be harrowed with things that can be done away with, like data entry. And customers are fickle - you don’t want to lose them because you didn’t play a smart pricing game and very openly passed on increased taxation to them when instead you could have adjusted your pricing model to make prices seem at par. Online accounting software prepares you for these modern-day business challenges.